It’s no secret that people need to check their credit reports regularly to ensure that the information they are reporting is correct. The credit bureaus determine the number of credit reports that you receive in a year, and each of them has its guidelines for what information to report. As such, when checking your credit reports, it’s essential to be aware of which of the bureaus to contact and what information to query or challenge. Here’s what you need to know:

One of the first things you should look for on a credit report is delinquent payments. If you have several late payments reported against your credit history, then the most likely reason is that you have fallen behind on your bills. Delinquent accounts can stay on your report for up to seven years, so paying them off may not only improve your score but also help to prevent other problems from developing in the future.

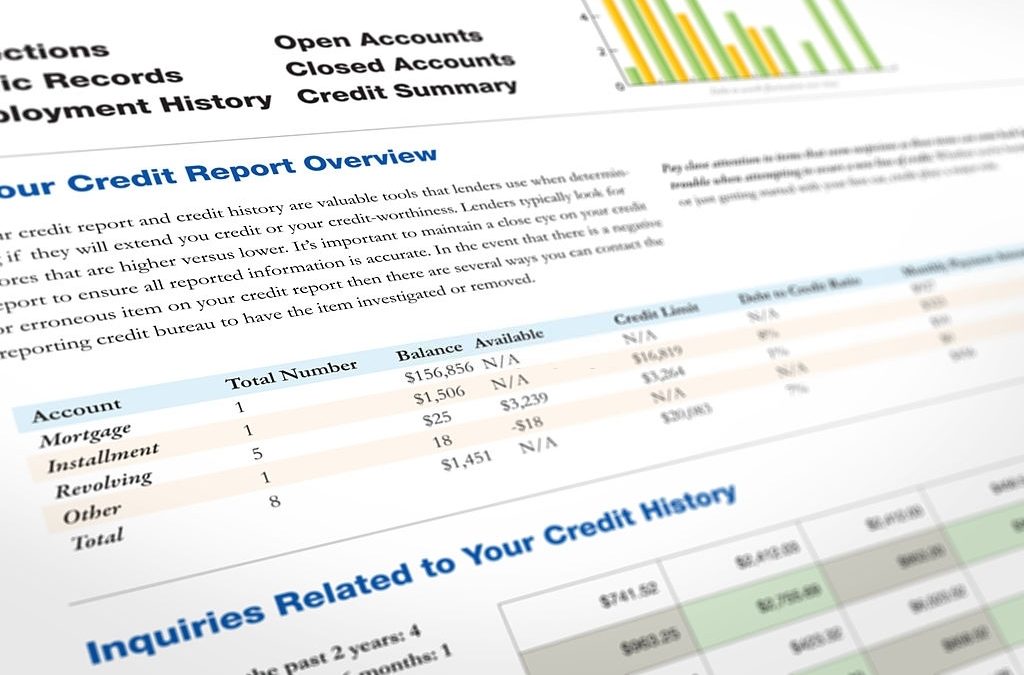

It would help if you also looked for any closed accounts that you might have. While it’s true that all secure accounts will eventually be removed from your credit history, some companies prefer to maintain them. Typically, these companies are interested in keeping a stable customer base, so they will often stay open accounts that are inactive for a while. This means that even if you don’t use a particular credit card anymore, you could still have a remaining balance on one. Inquiring about closed accounts with the company you’re using to determine your credit score can help you narrow down the field.

Checking your current credit report for errors is an essential step in improving your credit score. The credit report is not considered the document of your financial history, so you shouldn’t try to interpret it in that way. Instead, take a moment to note any instances where different addresses are listed for the same credit cards or debts. Also, be sure to note any delinquent accounts that you know about.

If you find something that you believe may be an error, contact the reporting agency as soon as possible. While many people assume that it’s beautiful to wait until an account listed on your credit report has a more than seven years old balance, this isn’t a good idea. An older account listed as delinquent can affect your credit score. For this reason, it’s strongly recommended that you get the delinquent status changed immediately. In addition to being found delinquent, it will also cause your creditor to raise your annual fee.

The third element to keep in mind when learning how to read a credit report is three different reporting bureaus. Each has its credit reporting process and method, and each has other guidelines regarding what is considered a hard inquiry or soft inquiry. Generally speaking, hard inquiries are considered those from creditors who request documentation relating to your payment history. Soft inquiries are usually from lenders who look for information such as your mailing address or phone number. There are a few instances when both hard and soft inquiries will be recorded on your report, as with hard and soft inquiries, a creditor who makes a hard inquiry will be required to notify you in writing.